By – Meenal Kadekodi

Solutions Architect, eMerge

Effective financial consolidation is a rigorous process requiring accurate data, expert project management across all entities, and compliance with accounting regulations.

As you scale, consolidation increases in complexity. Despite this, many growing companies still rely on processes or on tools which are person oriented. Most group companied use MS Excel for preparing Consolidated Financial Statements

Common Challenges faced while generating Financial Consolidation Reports

1. Low quality Data

Often while preparing consolidated statements, some manual data is entered at various levels to bring the standalone numbers of entities to align with consolidation requirements. These data elements do not have proper tagging and explanation, resulting in bottlenecks and Audit Delays.

2. Failure to Automate Consolidation Process

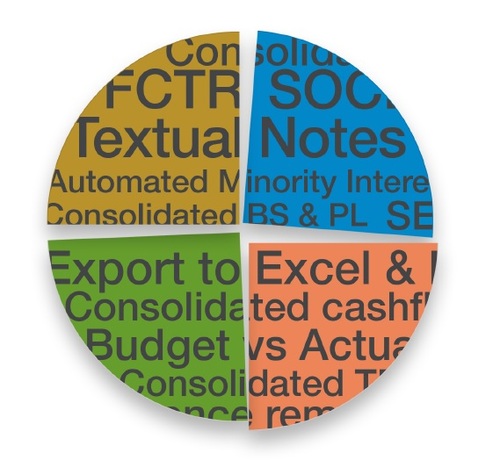

Invest in software that specializes in Financial Consolidation of Multiple Companies. Various Consolidation Standards should be inbuilt into the tool.

3. Identifying and reconciling Inter-company transactions

Here the challenges are maximum since all the group entities may not be on the same ERP platform. Best scenario is to have a Common ERP implemented with a central control over the Chart of Accounts. However, this is not practical and may also be expensive. Hence defining a process which can be followed by all group companies to prepare the Eliminations data is important activity. A proper Software can help in simplifying this.

4. Adapting to the changes in Reporting requirements

Regulatory body keeps making changes for the disclosures required to be submitted by listed companies. A proper flexible and simple to use Software will be of immense help to modify the reports and make these available downstream to all entities in the group. This will ensure that the Consolidation activity will be performed in a smooth way.

5. Data Manipulation and Risk of Fraud

If the tool used for preparing Consolidation statements does not have a proper Audit Trail and traceability of all data elements, there will always be a risk of data manipulation. Look for Solutions that will integrate with the ERP systems to automatically fetch data required for Consolidation. Whatever additional inputs are required should have proper Tagging, Bucketing and Audit trails to make everything transparent.

6. Complications arising due to Multi Currency handling

Most Companies have entities across countries and hence Consolidation process involves data of Multiple Currencies to be converted. Automating FCTR computations and its traceability is utmost important in the tool / Software used.